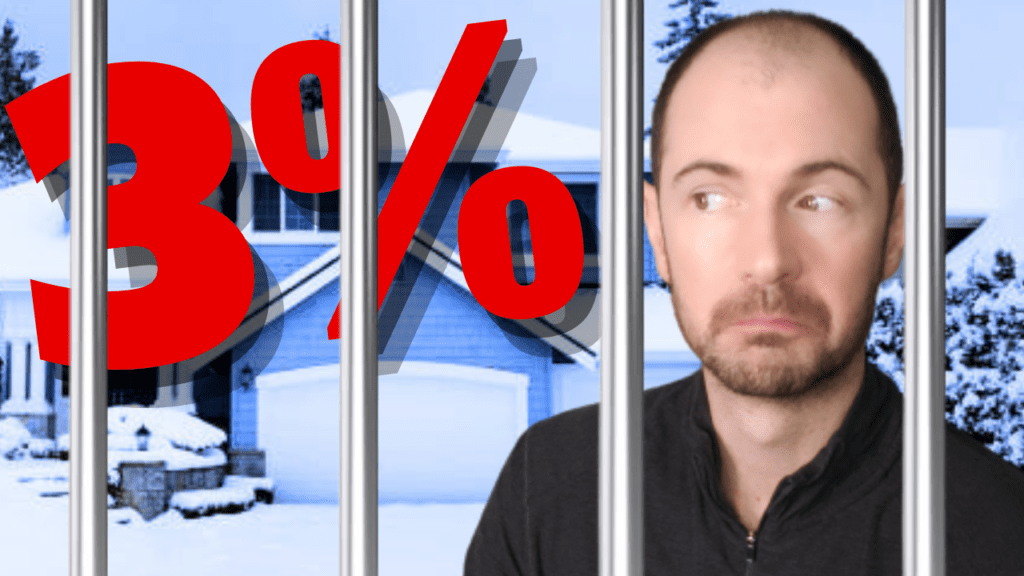

Homeowners Are Trapped! Reasons to Buy at a Higher Rate

So you bought your first home in the last few years or you refinanced your home into all time low rates and now you want to move. But you don’t want to give up that sweet low rate and payment, what to do?My name is Chris O’Connell, I’m a mortgage loan originator, and as I home buyer myself, I’m faced with the same conundrum. Many potential homeowners are trapped by low mortgage rates. So I’m going to talk about when it actually makes sense to ditch your low rate and buy a new house even if it’s a higher rate.

Getting Married

This first reason is something many of you can relate to. My first single family house was a little 3 bed one bath house in Minneapolis, and I loved it. It was all mine and best of all I bought it for a steal and my rate and payment were very affordable.

Then I eventually met a gal and got engaged. She owned a house too so we had to decide where to live. I didn’t want to live in her house and she didn’t want to live in mine. The only solution was to start fresh and buy a house together, which we did before we we got married.

This of course is the first of many life events that come up which would motivate you to purchase a new home, which is getting married or getting engaged. Besides 2 buyers is better than one in this market and you’re sharing in the monthly expenses so it can make sense from a financial perspective.

Growing Household Size

The second reason is having kids or a growing in household size. This is definitely a reason why I would want to buy something new. Of course you need the space for the kids, but your own sanity as well. Not to mention the schools, or you want to get out of the city, or move to a safer neighborhood – in this case I don’t care what the mortgage rate is, I’ll just refinance later!

Speaking of which, you could use a rehab loan to refinance and get money to fix up your current home, add bedrooms, bathrooms, additions and accessory dwelling units – they’re called HomeStyle and 203k loans.

Work Relocation

Sometimes you might not have a choice, I talk to a lot of people that need to move for work or they’re relocating for work and that’s just what needs to happen. And if you own something, you don’t really want to go back to renting, especially if you’re moving somewhere new and want to put your roots down and settle in.Â

Your time horizon is a big consideration, you might not want to do this if you’re going to have to move again in 12-24 months, but if you’re in it for the long-hall, you want to buy regardless of the rate assuming you can afford it.

Divorce or Separation

After years of eating food off my plate and not leaving me any closet space, you might be getting a divorce. Of course this can be an emotional time but mortgage rates don’t change because you didn’t have the right response to, “does this dress make me look fat?”

If one of you is keeping the house and you’re both on the mortgage, the person staying in the house most likely needs to refinance the other off the mortgage, and that means you’ll need to refinance at whatever current rates are. If you’re not staying in the house, that might mean buying a new house at whatever current rates are.

Downsizing

Regardless of how long your marriage lasts, if you have kids, or whether you want to stay in your house or not, at some point you may want to downsize. The kids are out, you don’t need or want to take care of a big house, maybe you want something more convenient or you’re finally ready to move to Florida.

You might sell your current home and buy the next one with all cash! Or you’re using a reverse mortgage to get rid or your mortgage payment altogether. A reverse mortgage is also a pretty cool option depending on your situation.

Even if you don’t specifically fall into any of these categories, don’t put too much weight on the rate. Life’s too short to be trapped in a house just because you have a low rate. Buy what you want assuming you can afford it and it meets your lifestyle.

Marry the house and date the rate! If you’re a repeat buyer or investor contact me about your next home purchase and start your pre-approval here by completing your online mortgage application.