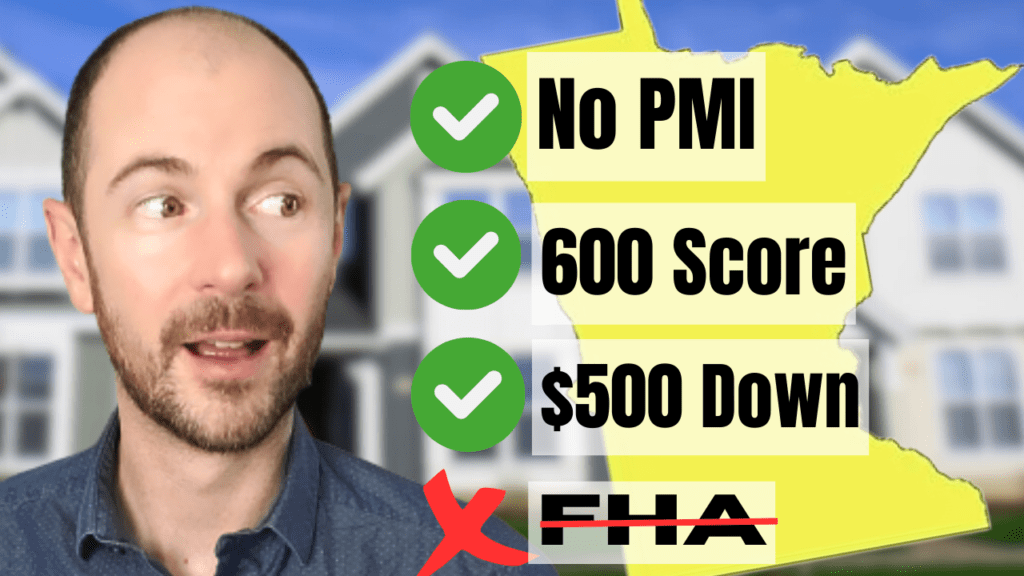

Literally the BEST Loan for Minnesota Home Buyers

This is literally the best first time home buyer program in Minnesota, ever! You can have a 600 minimum credit score, a minimum down payment of $500, and there’s no mortgage insurance. I can tell you right now that there is no better program available out there. After being a mortgage loan officer for over 12 years, I have never seen anything that beats this and I would highly recommend applying for this program.

With any other mortgage program out there, there’s always a tradeoff, anytime lenders claim that you can go lower on your credit score, 1% down, zero down, or get down payment assistance, the mortgage insurance, interest rate, and fees are all higher.

So what’s the tradeoff with this program, is the rate and fees higher? The short answer is no. In fact the interest rate is actually lower and less expensive than any other conventional loan or FHA loan available out there, which is what makes this such an awesome program. This program is available throughout the state of Minnesota to purchase one unit properties and there’s a bonus forgivable grant program that you can layer on top too.

First Time Buyer Mortgage Rate

First let’s talk about rate because this obviously a big factor when it comes to affordability these days. The rate on this program is at least 1% lower than the average 30 year fixed rate mortgage published by Mortgage News Daily. You don’t pay any points for it regardless of your credit score, you can have a 600 score or an 800 score, the rate is the same for everyone.

Even if you found some super cheap discount online mortgage lender that will claim to beat this rate with no additional lender points and fees, they could not beat the fact that there is no private mortgage insurance with this program.

Community Reinvestment Act

How can a bank give away low rates, no mortgage insurance, and low fee, who’s paying for this? This program is actually a result of the Community Reinvestment Act that requires community banks to reinvest int their communities, and the product that I’m writing about today is offered by Old National Bank.

How to Qualify for the BEST Loan for Minnesota Home Buyers

The main qualifying factor for this program is you have to be under 80% area median income and that limit is $99,440 per year of qualifying income in the Twin Cities. This isn’t household income, but qualifying income on your mortgage application. If you think you’re over this, you can exclude bonus, overtime, commission, or any other part time job or self employed income to get you under this limit.

This is only for one unit properties, single family homes, condos and townhomes that you intend to occupy, so you have to live in the property and you can’t have any non occupying co-borrowers. It probably goes without saying that this is not for 2nd homes, investments, manufactured homes, or multi unit properties.

What’s the Minimum Credit Score to Get Pre-Approved

The minimum credit score is 600. You have 3 scores, the middle one needs to be 600 or higher. All judgements and tax liens need to be paid off. You can’t have individual collections or charge-offs in the amount of $300 or more. You have to pay them off – medical collections not included. If you have a total of $1000 or more in aggregate collections and charge offs, they must be paid in full, medical not included.

If you’re currently paying rent, you have to show a satisfactory 12 month on time rent payment history with no late payments. If you have bankruptcies, foreclosures, or short sales in the past there are waiting periods for events like that which are basically the same as fha and conventional loans.

What’s the Minimum Down Payment for First Time Buyers in Minnesota

You do need to put 3% down on your purchase, and $500 of that needs to be your own money. In other words, you can get a gift from a family member, use retirement accounts, your own savings or a grant to come up with that 3% but $500 needs to come from you.

Minnesota Home Buyer Forgivable Grant

If you are buying a home in Hennepin or Ramsey counties, you are automatically eligible for a $10,000 or 3% of your purchase price up to $10,000 or up to $15,000 in minority majority census tracts. I made a video specifically about this program which you can watch here.

The seller is allowed to contribute up to 6% of the purchase price towards the buyer’s closing costs. Compare this to a 3% down conventional loan, the seller can only contribute up to 3% so this could be a super valuable feature for the right property.

One other thing you need to consider is that if for some reason this particular program doesn’t work, you will have other options available such as FHA, homeready, homepossible, regular conventional loans, USDA, VA loans, new construction and down payment assistance. If you’re interested in using this program, you can contact me here or fill out a mortgage loan application.