Mortgage Rate Predictions for 2024

A simple Google search for mortgage rate predictions for 2024 will tell you that most economists think rates will go down in 2024. But that’s what they’ve been saying and rates keep going up. What can you actually expect mortgage rates to do in 2024? There’s a case for rates going down in 2024 and it’s a stronger case than it was 12 months ago. However, there is also a case for higher rates, but I’ll talk about why that’s less likely.

Mortgage Rate Predictions

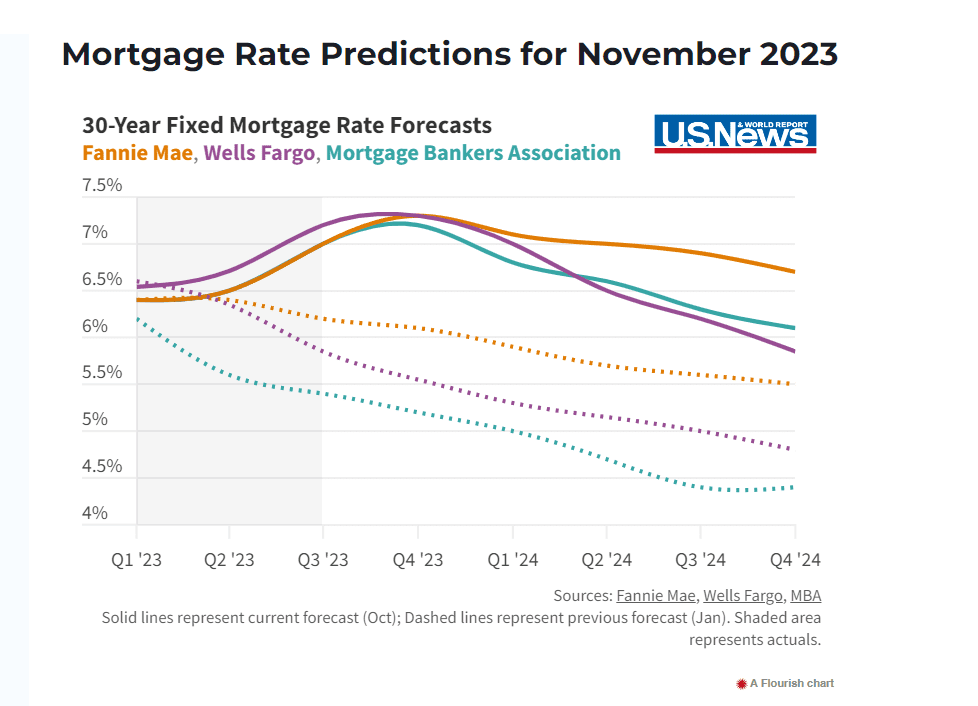

The Mortgage Bankers Association MBA is predicting rates that mortgage rates will fall to 6.8% in the first quarter of 2024 and all the way down to 6.1% by the end of the year. As of this writing, the average 30 year fixed rate is right around 7.5% after hitting 8.03% just weeks earlier.

Fannie Mae has a similar prediction that rates will start at 7.1% in the first quarter and gradually decline to 6.7% by the end of the year. So the trend is the same, where we’ve already seen the 8% peak in 2023 and we’ll see a gradual decline throughout 2024.

How Accurate are These Mortgage Rate Predictions?

Not so fast! We’ve heard this before, and you’d be right. Here are their predictions from last January and here’s what rates actually did. You can see that Fannie, MBA, and Wells Fargo were a little too optimistic.

Rates stayed elevated because of a strong economy, strong jobs data, and less demand for US Treasuries and Mortgage Backed Securities pushing down prices and pushing up rates. Why would rates go down in 2024?

Will Mortgage Rates Will Go Down?

The simplest answer and one the Fed has said is that we’re only starting to see the affects of higher rates in the economy. There are some red flags and cracks starting to appear, one of which is consumer debt hitting an all time high. Student loan payments just started recently, which will affect consumer spending. Unemployment has started to slowly increase as well.

That all suggest that we could see a slowdown in economic activity, leading to lower inflation, and ushering a soft or hard landing. This gives the Federal Reserve an excuse to stop raising rates or start lowering rates.

Both MBA and Fannie are predicting negative GDP growth in the first part of the year, although they were predicting negative growth in 2023 and that did not happen. In fact we had very strong GDP growth all year, so to predict we’ll go negative in the next 6 months, I think is unrealistic.

Because growth was so strong, rates continued to rise. It would appear that we’ve hit a ceiling on rates for now, but we could break through that ceiling and see higher rates for a few reasons.

Will Mortgage Rates Go Up?

The fed has said there’s still a tough road ahead to get inflation down to the 2% target. Even though inflation is well off its highs last year, many economists expect inflation to get sticky, making the case for higher rates for longer.

In addition we also have the issue of massive government debt being issued all around the world and less demand for this deb; pushing prices down and yields up. It’s the same with mortgage backed securities which ultimately determine mortgage rates. Banks and investors aren’t’ buying these assets because of new bank regulation and rate uncertainty.

If this continues, you’ll see rates moves even higher, possibly breaking through that ceiling and going higher than 8%. The reason why this scenario is less likely is because in hindsight, this has already happened for the most part We’ve already seen a quick and drastic rise in fed funds rate and mortgage rates. Debt prices have come down, demand has come down, but we still haven’t seen the true affects of higher rates on the economy.

I think you do start seeing those effects going forward, because it takes 12-18 months of higher rates to see households deplete their cash, drive up credit card debt, and start making higher payments on student loans and mortgage payments. Combine that with lower wage inflation and higher unemployment, you’ve got a stronger case for lower rates in the next 12 months.

Mortgage Rate Prediction for 2024

The overall risk and uncertainty makes a stronger case for lower rates. Perhaps not drastically lower (as all that sounds dramatic) but it won’t happen overnight. It’ll be a slow burn and I think you see rates closer to 6.5% by the end of 2024 instead of 7.5%.

Global Risk

There’s also serious risks happening globally. Bill Ackman, CEO of Pershing Square Capital bet against US Treasuries when rates started going up, which turned out to be a great investment. However, recently said he’s buying treasuries because, “There’s too much risk in the world to remain short bonds.â€

Shorting bonds is Wall Street speak for betting bond prices keep going down and rates keep going up. There’s also got a big slowdown in China and Europe and don’t forget about the banking crisis! The 5th bank failure of the year just happened. A small community bank in Sac City, Iowa, has failed after examiners identified “significant loan losses that had not been previously identified,” according to a statement by the Iowa Division of Banking.

Higher for longer is the mantra for now, but hopefully not that high. As a home buyer, I’m not trying to time the market. However, I’ve seen a big slow down in the housing market in my area; there’s a lot of homes sitting on the market for longer, sellers reducing their prices, and offering seller paid closing costs to buyers. Regardless of the rates and housing affordability, home buyers do have it a little easier now than in the past 24 months.